Earlier this year, the Algrano team received requests from roasters to pre-book coffees from the Brazilian new harvest at the same prices of 2020. Though growers are always keen to get early contracts as it provides extra security, they couldn’t keep prices at the 2020 level. “Why are Brazilian coffees more expensive this year?” roasters asked. To answer this question, we spoke to our long term partners at SanCoffee in Campos das Vertentes, Minas Gerais, to give roasters a quick update about what’s going on on the ground.

.jpeg?width=4838&name=Fazenda%20Samambaia%20(11).jpeg)

Algrano spoke to many of our partners in Brazil over the last couple of months and all of them estimate to keep prices stable. However, some producers who reduced their prices in 2020 due to COVID are returning their rates to pre-pandemic levels, hence the impression of more expensive coffee.

Let us be honest. Buying coffee from Brazil in 2020 was a great deal! 2020 was a super-harvest year with record volumes, the quality was outstanding, the local currency (Brazilian real) was depreciated and demand was uncertain. Brazilian growers were able to reduce their prices without making a loss. This year is different. Hear if from the source:

A 12-year low crop

2021 is an off-cycle year following a record crop. The big production stressed the coffee plants to a higher extent than usual. On top of that, the main coffee-producing regions in Brazil suffered from a drought in the second half of 2020 brought by La Niña, with rains arriving only at the end of October/early November and disrupting the flowering season.

Later, the weather would also affect maturation because when the rains did come levels were much lower than the historical average. In January, CONAB (National Supply Company) forecasted that Brazil’s 2021 arabica production would be reduced by 35.7%, a 12-year low. Some growers tell us their crop will be reduced by 50%! And it is not only yields that are compromised. It is possible that we will see overall lower screen sizes too, though it is still early to say.

It was precisely in October 2020, as rains timidly began, that the arabica price spiked on the stock market. “But I am buying specialty coffee at fixed prices. Why should the C-market affect my coffee?” one might ask. Though micro-lots are usually priced high enough to maintain stable prices, the same is not true for high-commercials, the high volume 80-84 points coffees most use as blenders. High commercials are pressured to be much more competitive, have tighter margins and are more susceptible to the market’s variation.

.jpeg?width=6000&name=Fazenda%20Samambaia%20(18).jpeg)

There are other factors affecting the prices of Brazilian coffee. The real has began to recover after the pandemic slump, demand in consuming countries started to pick up as COVID vaccination campaigns allowed lockdown measures to be eased, container shortages and higher freight costs continue impacting exports, the recent strikes in Colombia are interfering with supply and the weather is still irregular in Brazil, leading to concerns about the 2022-2023 harvest. Uncertainty about a resurgence in COVID cases and high availability of past crop coffee means the market will continue to be volatile and it’s hard to predict if prices will go up or down.

What you can do about it

As a roaster, is there something you can do about it? Yes. The best approach to navigating volatility is to discuss a buying plan with your partners at origin. Pre-contracting and engaging in long-term contracts are two sourcing practices that get less attention than paying a high price but that can have an even bigger impact for both producers and for roasters. When there is stability it is easier to talk about price. And you become a more important customer. And producers can offer you better coffee. But it takes planning.

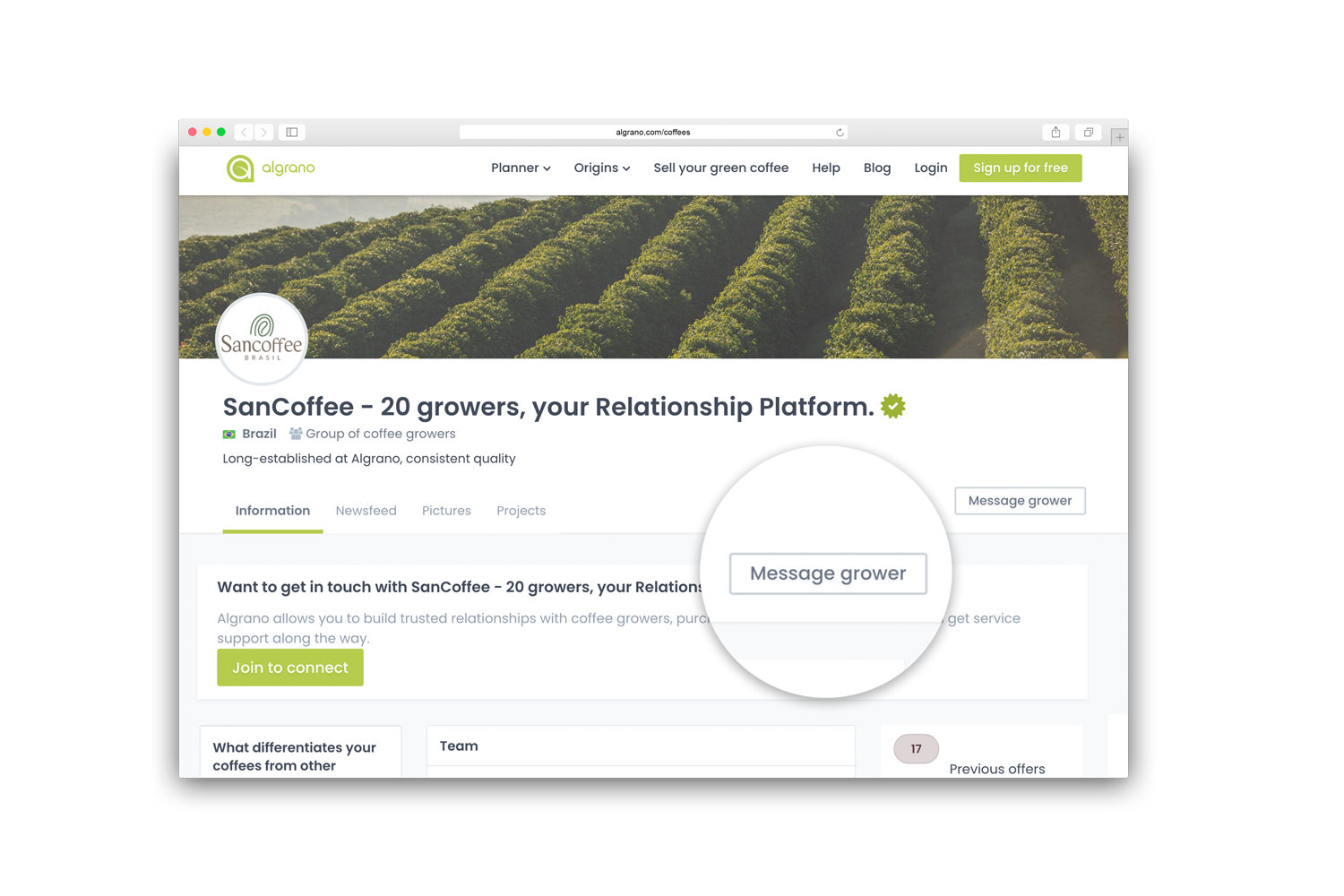

Algrano is here to help. Why not involve the grower when you discuss options with a sales manager? You can get in touch with all growers easily through the platform. Just visit the growers’ profile and click on “Message grower”. Check the sourcing planner. Other countries, like Rwanda and Peru, are also harvesting right now. This is a great time to start a conversation.

Let Us Know What You Thought about this Post.

Put your Comment Below.