[gallery]

Read the small prints

Let’s imagine that a year ago, you signed a working contract that obliges you to work in Brazil and rewards you excessively in US Dollars for that stressful life. Today your boss called and announced that he increases your salary by 2% due to your satisfying overall performance. You do your maths and figure out that 2% is approximately the same as if you had worked 1 more week the last 12 months. Why will you laugh at him and pay his lunch?

During that same year, the foreign exchange market has worked as well. And I am sorry to tell you, but it performed better than you: A year ago, you received 2.5 Brazilian Real for 1 US Dollar, today you get 4 of them. As you evaluate all your expenses in US Dollars, your daily life in Brazil became 60% cheaper. Your salary increase measured in Brazilian Reals is equivalent to the sum of monthly salaries of more than half a year of work!

Exchange rates influence revenues stronger than coffee prices

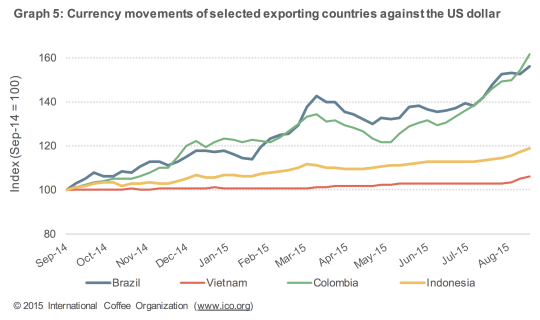

This is exactly what is happening to Brazilian farmers this year: The currency of coffee is the US Dollar and it appreciated by 60% in one year compared to the Brazilian Real (see graph below). If coffee prices had remained the same during this period, revenues of a Brazilian coffee farmer in Real would have increased by this same amount of 60%. This is good news.

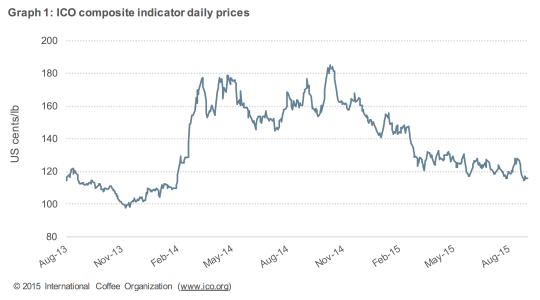

Of course, coffee prices fluctuate as well. Given that Brazil is the biggest coffee producing country, the loss in value of the Real impacts also coffee prices. Pictured in the second graph provided by the International Coffee Organisation, is a general price index. It decreased during the same period by around 30%. Hence, half of the gains in the cup due to the exchange rates, are sipped away. This is bad news. The same Brazilian farmer has lost the equivalent of his work from January until April, due to volatility in prices.

Darker coffee soon?

Should a farmer take profits and sell his coffee stock today? Or should he wait for coffee prices or the US Dollar to get stronger?

The Big Mac Index of the Economist, published in July of this year, suggests that the Brazilian Real is expected to strengthen in the future. Given the most severe Brazilian economic slowdown in decades, this will not happen tomorrow. But we should also expect the Dollar to strengthen against the Real, as the Central Bank of the United States will increase interest rates (or is Wallstreet right, and it won’t?). And oh yes, there is also the weather lottery. In other words, there is not an answer, there is only speculation.

What is granted though is that the world’s economic situation and current central banks’ cheap money policies, add extreme volatility to foreign exchange markets. Hence revenues of farmers, producing globally traded goods, outside Hawaii or Panama change dramatically. It leads to larger income variation than coffee prices and can destroy the fruits of half a year of work. This time it went in favor of the producer, but what is next year? And do not forget, fair minimum prices do not eliminate this variation. Also minimum prices are indexed in US Dollars. Honestly, would you sign that contract?

Let Us Know What You Thought about this Post.

Put your Comment Below.