Individual impact reports are now available for all roasters sourcing coffee through Algrano. An industry first, the document summarises the evolution of relationships between roasters and producers and prices premiums paid in comparison to widely adopted benchmarks.

Roasters sourcing coffee on Algrano can now request their unique impact reports, a two-page document based on contract data.

With this, Algrano gives roasters a comprehensive overview of their sourcing practices and relationships with coffee producers to be used for learning and as part of transparency reports.

Roaster impact reports will give platform users access to the same kind of data used by Algrano to measure the outcomes of our business model

This is an industry first. Whilst FOB pricing has always been transparent on Algrano, the report gives roasters the big picture of their green sourcing.

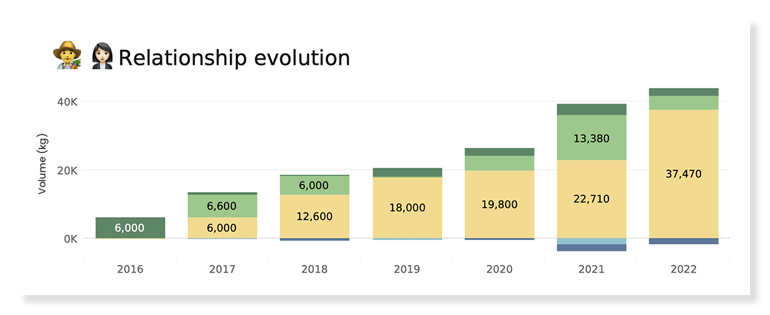

With the Relationship Evolution graph, roasters gain a simple and powerful tool to show the values behind their sourcing program. The chart was pioneered by Algrano’s Impact Report, released in April 2023.

➡️ Download Algrano’s 2023 Impact Report here.

This is our first time creating reports like this, so the current version is beta stage. It’s already been shared with a few customers who have requested them, including companies applying for B Corp certification.

To see what you’re report looks like, request it here.

In this blog, we’ll show what data you can see in the reports and the journey that has led Algrano to create them. We’ll highlight the benefits of reporting as a learning tool and a building block for a sustainable coffee industry.

- What’s inside the report

- How to get your report

- How the reports were created

- Why access to data matters

Inside the Report

With this report, roasters can easily see the evolution of their relationships with producers, the cumulative price premiums paid in comparison to industry benchmarks, certified volumes, order breakdown by quality, origin and type of producer, and coffee lots that are exclusive in their markets.

This is possible thanks to the technology behind the marketplace, where coffee offers and contracts are created digitally and managed on a centralised database.

“Oh, wow! That’s a very informative graph and it’s lovely to see the difference from year to year.” - Daniel Horbat, Sumo Coffee Roasters

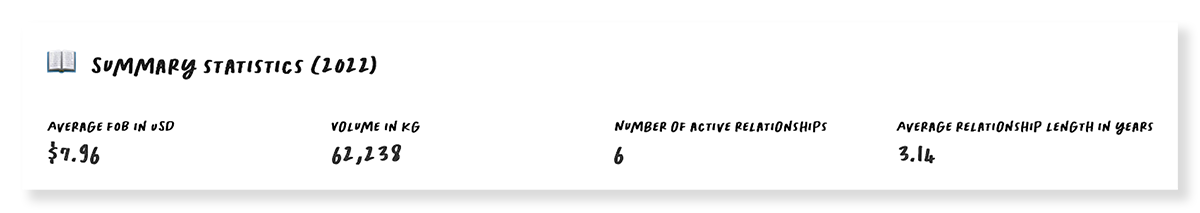

Summary Statistics:

A quick overview of the year’s sourcing with average FOB price paid, total volume, number of producers a roaster is currently sourcing from and the average relationship length for the previous year.

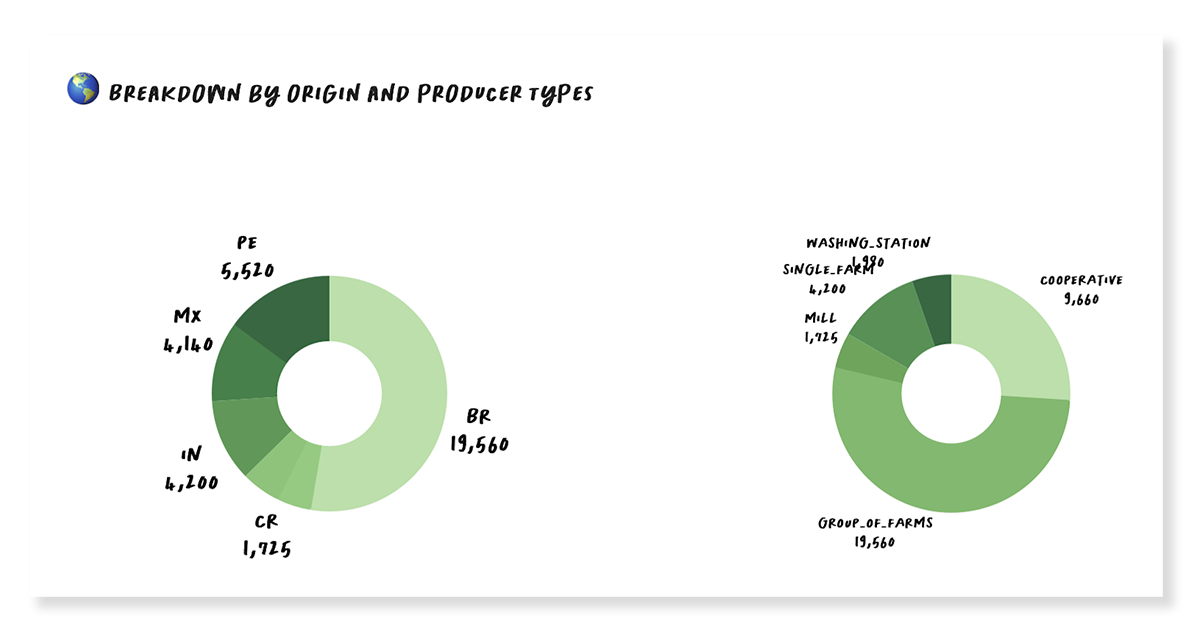

Breakdown by Origin and Producer Types:

Shows all the origins roasters are sourcing from according to volume and what type of producer supplies their coffees, from cooperatives to washing stations and single farms.

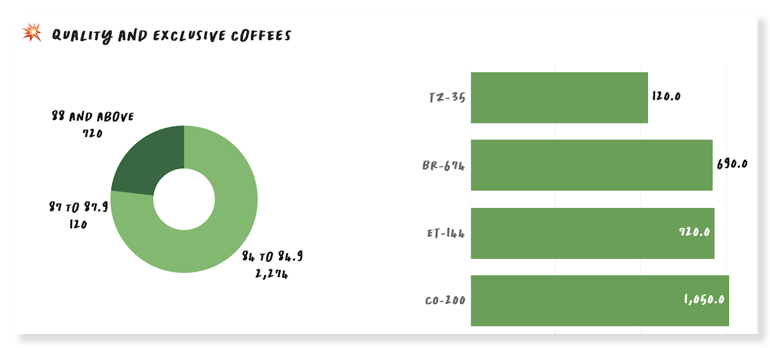

Quality and Exclusive Coffees:

Breaks down sourced volume by quality range. Also lists all lots that have been sourced exclusively by that roaster in their country.  Relationship Evolution:

Relationship Evolution:

Perhaps the most important graph in the report, it splits the total volume of coffee ordered according to relationship status. A roaster can see how much they are growing with existing producer partners (yellow and light green), how much coffee comes from new partnerships (dark green), and how much volume they stopped sourcing from partners (dark blue, referred to as “customer churn”).

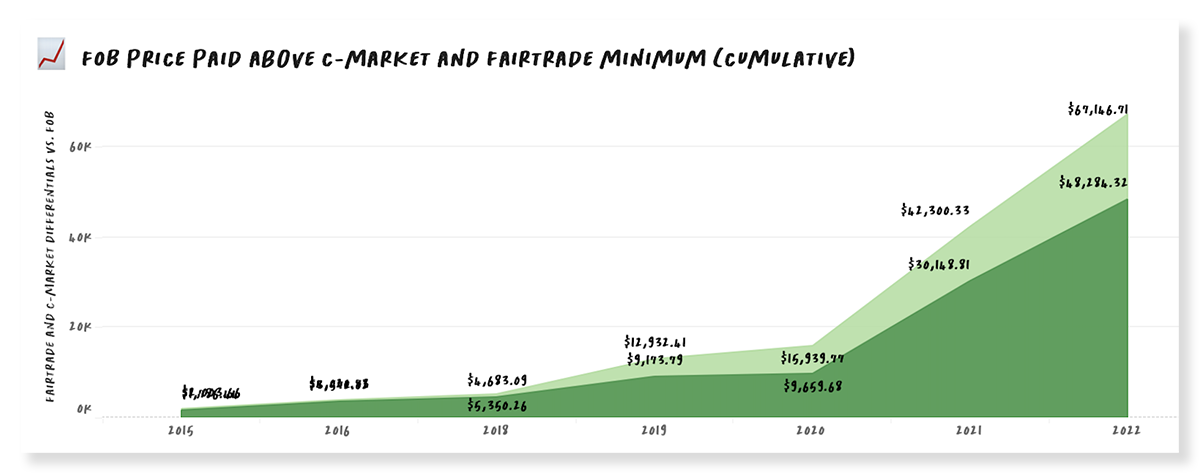

FOB Price Paid ABove C-Market and Fairtrade Minimum:

Shows how much money roasters have paid to producers beyond what they would be able to get if they were selling coffee in the domestic market according to the c-price. Roasters can also see how much they pay above the Fairtrade minimum price over time. These are the most used price benchmarks currently being used in the industry.

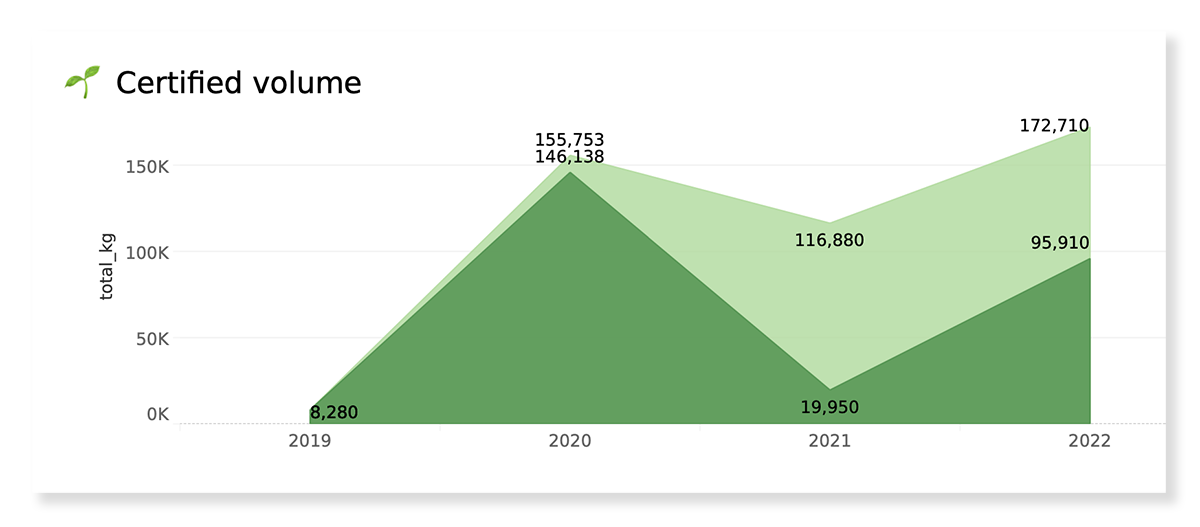

Certified Volume:

An easy view of how much of roasters’ coffees were purchased with a certification in comparison to their total volume over time.

Get your report here

Any roaster sourcing coffee on Algrano can request their individual report by completing the form below. Currently, we’re able to provide a summary for 2022, with a long-term overview of relationship evolution.

As the data is collected for the 12-month period between January and December, roasters’ 2023 summary will be available as of January 2024.

The learning curve

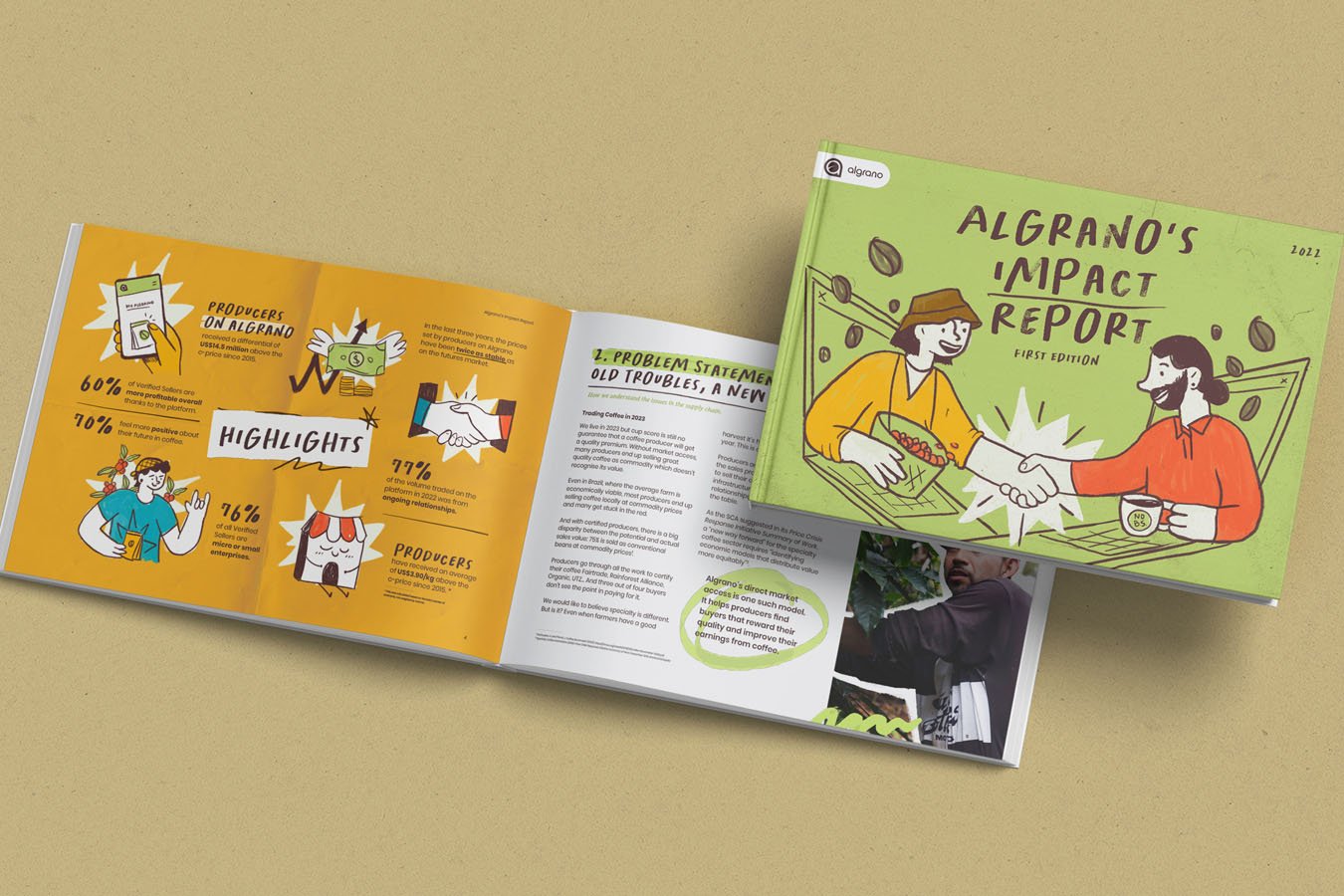

This initiative comes from Algrano’s first impact report. Having collected data from all transactions in the marketplace since 2015, it became easy for us to replicate the same model for roasters.

Algrano's Impact Report was published in April 2023

Going through our data gave us important insights into what Algrano’s model has achieved. It allowed us to understand better if we’re living up to our mission to “balance the power dynamics in the supply chain for a prosperous industry”. We learned that:

- Ongoing relationships between roasters and producers were behind 77% of all coffee contracted on Algrano in 2022.

- Producers received US$14.5 million above the c-price on Algrano since 2015.

- Platform prices have been two times more stable than futures prices between 2020 and 2022.

- The marketplace is a reliable sales channel for both large lots and micro-lots. And many sellers seem to benefit from a mix of new buyers and long-term partnerships.

It also highlighted areas for improvement and helped us build a three-year strategy to tackle challenges. Among other things, we decided to:

- Improve traceability of cooperative or exporter lots, produced by a range of farmers, many of them smallholders. These account for 40% of all the coffee on the marketplace.

- Make long-term relationships stronger and reduce the “customer churn” of small-volume orders.

- Explore pricing benchmarks to help roasters understand if what they’re paying is fair.

- Make the seller verification process more extensive and develop training around direct trade.

Why is coffee sourcing data important?

Data analysis can be confusing and time-consuming. But roasters should have the opportunity to learn about their sourcing through data and make informed decisions. This is especially important now that sustainable practices are in high demand from consumers.

Roasters can now easily see the evolution of their relationships with producers and the cumulative price premiums paid to suppliers at origin (Photo: Algrano)

Information about sourcing practices is crucial for roasters who are committed to improving the financial outcomes of coffee producers.

As described by the latest Coffee Barometer, most companies “tend to remain vague on strategic sustainability aspects, such as trading practices, fair price setting, or farmers’ living incomes”.

Ultimately, that’s a barrier to achieving the industry’s sustainability goals. So we came up with a simple view to help roasters understand data that is meaningful for their business and the coffee supply chain.

“That is some great work you guys are doing. It’s truly impressive to see the progressive team you guys are. Well done.” - Nikola Sunko, Bell Lane Coffee Roasters

Algrano is committed to strengthening relationships between coffee roasters and producers. We believe partnerships built on equal footing are mutually beneficial for businesses on both ends of the supply chain. If you share our enthusiasm for the values and potential of direct trade, Algrano is for you.

Let Us Know What You Thought about this Post.

Put your Comment Below.